Long Term Financial Goals: How to Plan for Retirement

Long term financial goals a powerful step toward financial security and achieving the lifestyle you envision. These goals aren’t about quick fixes they require commitment, foresight, and a strategic approach that can support you over a lifetime. From retirement planning to wealth accumulation, each financial goal serves as a cornerstone of your financial independence. Let’s dive into what makes these goals essential and how to build an effective roadmap to reach them.

Understanding Long-Term Financial Goals

Typically span five years or more, providing a sense of direction and purpose to your financial decisions. These goals guide major life milestones, such as owning a home, saving for your children’s education, or achieving a comfortable retirement. With careful planning and a disciplined approach, help you establish a stable foundation and build wealth over time.

The Importance of Retirement Planning

Retirement planning means setting aside resources now so you can enjoy financial freedom later in life. With life expectancy increasing and costs rising, it’s crucial to start planning as early as possible. A well-thought-out retirement plan provides peace of mind, knowing you won’t have to depend solely on external financial support during your retirement years.

Why an Investment Strategy Matters

Creating an effective investment strategy is crucial for building wealth and reaching financial independence. Investing allows your money to grow over time through compounding returns, which is especially beneficial for long-term goals. An investment strategy should align with your financial objectives, risk tolerance, and time horizon. Without a sound investment strategy, reaching your long-term goals can become challenging.

Types of Investments to Consider for Long-Term Goals

Long-term investors often benefit from a diversified portfolio, which can include stocks, bonds, mutual funds, and real estate. Stocks tend to provide higher returns over the long run, while bonds offer stability. Real estate investments can offer additional growth and income potential, making it an attractive option for some. Balancing these investment types based on your goals and risk tolerance is essential for sustainable growth.

Wealth Accumulation

This involves not just saving money but also investing it wisely to maximize returns. A key part of wealth accumulation is understanding how to leverage compound interest, which allows your initial investments to grow exponentially. Building wealth over time offers you a financial cushion, which can increase flexibility and improve your quality of life.

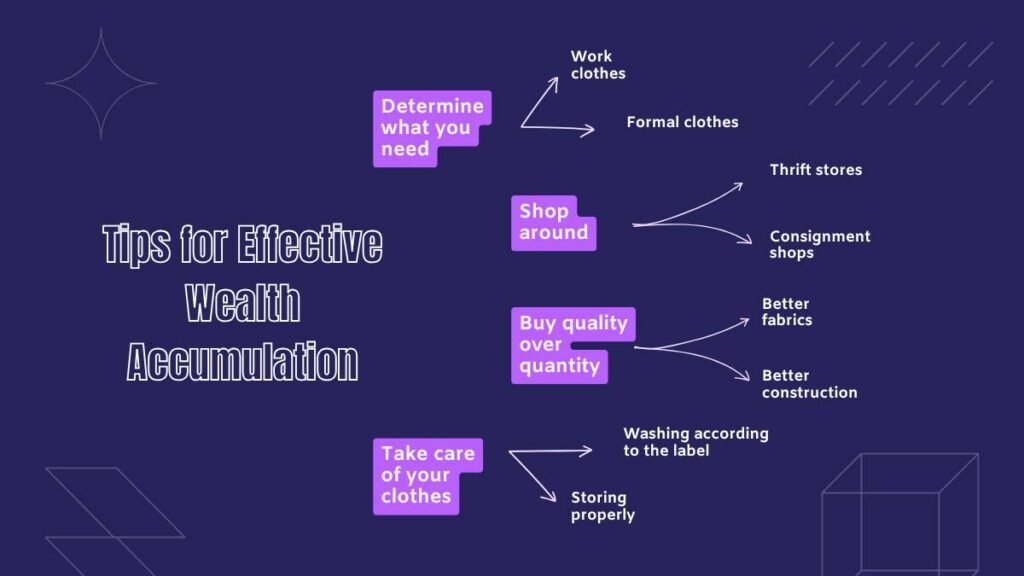

Tips for Effective Wealth Accumulation

To build wealth successfully, start by saving consistently, regardless of the amount. Automating contributions to your savings or investment accounts can ensure steady growth without requiring daily involvement. Additionally, review your financial plan periodically to ensure it aligns with your long-term goals. By staying consistent and focused, wealth accumulation can become a manageable and rewarding process.

Steps to Reach Financial Independence

To reach financial independence, begin by evaluating your current income, expenses, and financial habits. Reduce any unnecessary expenditures and channel more funds into your savings and investments. Focusing on building a diverse investment portfolio can increase income streams, further supporting your goal of financial independence. It’s a journey that requires patience, but the rewards of financial freedom are worth it.

The Role of Portfolio Diversification

Portfolio diversification is a fundamental aspect of long-term financial planning. By spreading investments across various asset classes, you reduce risk and enhance the potential for steady returns. When one asset class underperforms, gains from another can help offset the loss, making diversification a protective strategy against market volatility.

Strategies for Effective Portfolio Diversification

Effective diversification involves balancing high-risk and low-risk investments. Consider mixing stocks, bonds, real estate, and commodities. You can also explore international investments, which reduce dependence on any single market. As your goals evolve, rebalance your portfolio to maintain an appropriate level of risk and return. With a diversified portfolio, you’re better positioned to weather market fluctuations while steadily working toward long-term goals.

Starting Early

By starting young, even small investments can accumulate substantial returns through compounding. For example, someone who starts investing at age 25 will have a much larger retirement fund than someone who begins at 35, even if they both contribute the same amount annually. Consistency and time are your best allies when it comes to building wealth.

Building an Emergency Fund

Keep this fund in a separate savings account that’s easily accessible. Having a robust emergency fund protects you against job loss, medical emergencies, or other financial shocks that could hinder your long-term financial journey.

Importance of Financial Education

Staying informed about financial principles, investment options, and market trends empowers you to make sound decisions. Financial education is a lifelong journey that can enhance your confidence in managing money, help you avoid financial pitfalls, and improve your ability to achieve long-term goals.

Conclusion

Achieving long-term financial goals requires a blend of strategic planning, disciplined saving, and smart investing. From retirement planning to financial independence, each goal contributes to a secure and fulfilling future. Stay focused, be patient, and regularly revisit your financial strategies to adapt to changes in your life and market conditions. With dedication and careful planning, your long-term financial aspirations are well within reach.

FAQs

What are the most important long-term financial goals to consider?

The most essential long-term financial goals include retirement planning, wealth accumulation, achieving financial independence, and creating a diversified investment portfolio to protect against market volatility.

How much should I save for retirement?

The amount varies based on lifestyle, expected expenses, and retirement age. A common guideline is saving enough to replace 70-80% of your pre-retirement income, but personalized planning with a financial advisor can provide a more accurate target.

How does portfolio diversification help in achieving long-term financial goals?

Diversification spreads investments across various asset classes, reducing the impact of poor performance in any one area. This balance minimizes risk and increases the potential for steady growth over time.

Why is financial independence important?

Financial independence provides the freedom to make life choices without financial constraints, such as retiring early, pursuing passions, or working on personal projects without relying on an active income.

How frequently would it be advisable for me to survey my drawn out monetary arrangement?

It’s advisable to review your financial plan at least once a year or after any major life change. Regular reviews help you stay aligned with your goals, adapt to new circumstances, and make necessary adjustments.