Automated crypto trading platforms global attention as investors look for profitable, high-growth opportunities. However, due to the crypto market’s volatility and around-the-clock nature, managing trades manually is challenging. That’s wherecome into play. Leveraging technology, these platforms streamline the process, making it accessible to more traders and reducing the time commitment required. Let’s explore the fundamentals, benefits, and workings of, along with some insights into popular tools and strategies.

What is an Automated Crypto Trading Platform?

An automated crypto trading platform is software that uses algorithms and artificial intelligence to conduct trades on a trader’s behalf. These platforms are programmed to buy, sell, and hold assets based on set criteria, such as price points, trading volume, and more complex technical indicators. They are designed to analyze market conditions, execute trades, and manage portfolios efficiently without constant manual intervention. Automated crypto trading platforms make trading easier, particularly for those new to the field, allowing traders to participate without in-depth knowledge or experience. This process is particularly valuable in cryptocurrency markets, where prices can shift dramatically in seconds.

How Crypto Trading Bots Work

Crypto trading bots are essential tools . These bots are algorithms or programs that connect to exchanges, monitor market data, and make trades based on specific instructions. The most effective bots continuously scan for trends and execute orders precisely when certain conditions are met, saving traders time and improving their chances of success.

Rise of Algorithmic Trading in Crypto

Algorithmic trading has revolutionized traditional financial markets and is now making waves in the crypto world. Unlike human traders, algorithmic trading software can process vast amounts of data and make decisions in milliseconds, which is critical in a fast-paced market like crypto. Automated crypto trading platforms rely on algorithmic trading to minimize human error and maximize efficiency. Algorithms help eliminate emotional decision-making, a common problem in manual trading, where sudden market shifts can lead to panic buying or selling.

Types of Automated Crypto Trading Strategies

Different strategies can be deployed on. Here are some widely used strategies that cater to varying risk profiles and trading objectives.

Arbitrage

Arbitrage bots capitalize on price discrepancies across different exchanges by buying low on one platform and selling high on another.

Market Making

These bots put in trade requests to benefit from the bid-ask spread, giving liquidity to the market.

Must Visit: Well Wave

Trend Following

A trend-following strategy involves buying when the market trend is bullish and selling in a bearish market, capitalizing on long-term price movements.

Mean Reversion

This technique accepts that costs will ultimately return to their mean. Bots buy assets when they are undervalued and sell when they are overvalued.

Essential Tools for Cryptocurrency Investment

Besides trading bots, there are a variety of tools available to enhance crypto trading strategies. These tools can help traders optimize their investment decisions and better manage their portfolios.

Crypto Analytics Tools

Tools like Glassnode and CryptoQuant offer insights into on-chain data, trading volumes, and market trends, enabling traders to make informed decisions.

Portfolio Management Platforms

Apps like CoinTracking or Blockfolio assist traders in tracking their investments and performance over time.

Signal Services

Many automated trading platforms offer signal services, which provide notifications about favorable market conditions based on technical indicators.

Risk Management Software

Tools that focus on managing risks, like 3Commas and Quadency, help traders allocate resources appropriately and minimize losses.

Understanding Crypto Market Analysis

To optimize their trading strategies, investors must understand crypto market analysis. By studying past and present data, traders can make predictions and align their strategies with market trends.

Fundamental Analysis

This involves evaluating the intrinsic value of a cryptocurrency by analyzing its team, technology, and overall market potential.

Technical Analysis

Focused on price patterns, trading volume, and other metrics, technical analysis helps traders predict price movements.

Sentiment Analysis

Analyzing social media and news sources for public sentiment can provide insights into the market’s direction. Understanding these forms of analysis helps traders better interpret bot actions and fine-tune their automated strategies for better performance.

Risks Associated with Automated Crypto Trading

While automated trading platforms have advantages, they come with certain risks. Understanding these risks is vital to ensure informed investment decisions.

Market Volatility

The crypto market is highly volatile, and bots can sometimes struggle to adjust to rapid changes, potentially leading to losses.

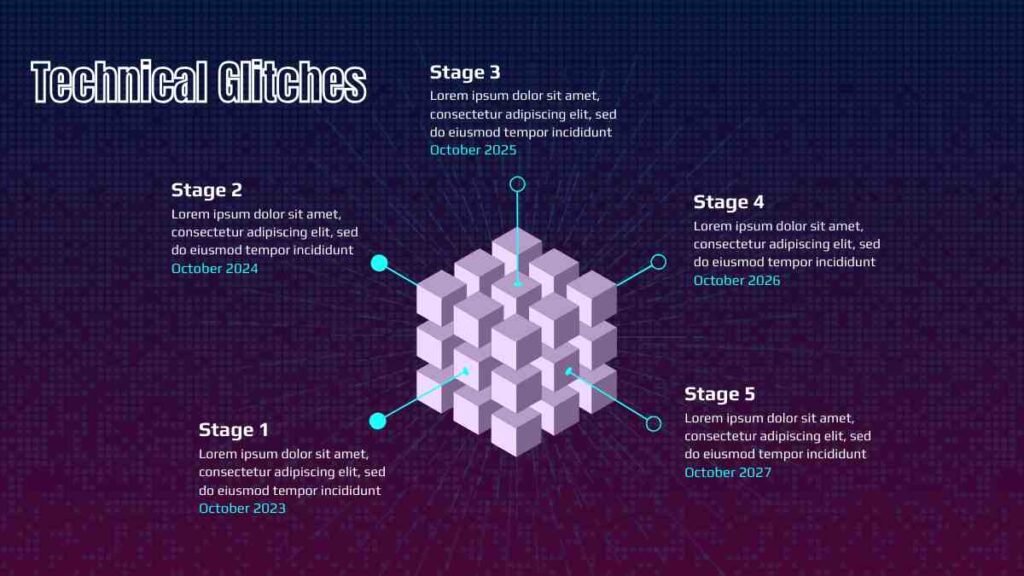

Technical Glitches

Errors in algorithms or connectivity issues with exchanges can cause trades to be missed or incorrectly executed.

Over-Optimization

Overly complex strategies may perform well in backtests but fail in real market conditions due to overfitting.

How to Right Automated Crypto Trading Platform

Selecting the right platform depends on your experience level, trading goals, and the platform’s reputation. Here are some considerations .Popular platforms like Pionex, Bitsgap, and CryptoHopper provide various features catering to different types of traders, allowing both beginners and pros to engage with the crypto market more effectively.

Conclusion

Automated crypto trading platforms have revolutionized how traders approach the cryptocurrency market. By leveraging algorithms, AI, and crypto trading bots, these platforms enable faster, more efficient trading while minimizing the effects of human emotions and time constraints. However, it’s essential to understand the risks and choose the right platform to achieve the best results. With the right strategy and tools, automated crypto trading can be a powerful way to make more informed and profitable investment decisions.

FAQs

What is an automated crypto trading bot?

An automated crypto trading bot is a software program that automatically executes trades based on predefined criteria, saving traders time and reducing emotional trading.

Are automated crypto trading platforms secure?

Most reputable platforms prioritize security, but it’s essential to choose a platform with robust security features, like two-factor authentication and encrypted connections.

Can I lose money using automated trading strategies?

Yes, automated trading carries risks, especially in volatile markets. It’s significant to have a gamble the executives procedure set up to limit likely misfortunes.

Do I want programming abilities to utilize a crypto exchanging bot?

Many platforms offer user-friendly bots with preset strategies, so programming skills are not necessary. However, advanced users may benefit from customizing their bots through coding.

How much does it cost to use an automated trading platform?

Costs vary; some platforms charge monthly fees, while others take a percentage of profits. Be sure to compare platforms to find one that fits your budget and trading needs.

Read More: Future Technology Predictions